As we all are aware that from this year onwards E-Verification of Return has been started by the Income Tax Department which will enable ITR V free Income Tax Return Filing. This will help in Efiling Income Tax Return without sending the ITR V to CPC Bangalore. Income Tax Department has started EVC filing and has also laid down the steps to be followed by an assessee to file ITR V free Income Tax Returns.

Below are the three ways through which the Income Tax Return can be filed:

1 e-Verification while uploading a return (Non -NetBanking)

2 e-Verification of an already uploaded return (Non -NetBanking)

3 e-Verification while uploading a return through NetBanking Login

1 E-VERIFICATION WHILE UPLOADING A RETURN (NON -NET BANKING)

1 Upload Return-------Click Submit

2 The Return is uploaded (Pending for e-Verification)

3 Four e-Verification options provided – Taxpayer can choose any one of the options provided to e-Verify the return.

Option-1 “I already have an EVC and I would like to Submit EVC”

Option-2 “I do not have an EVC and I would like to generate an EVC”

Option-3 “I would like to generate Aadhaar OTP to e-Verify my return”

Option-4 “I would like to e-Verify later/ I would like to send ITR-V”

Option 1 – “I already have an EVC and I would like to Submit EVC”

Step 1: Provide the EVC in the text box Click Submit.

Step 2: Download the Acknowledgement (No Further action required).

Option 2 – “I do not have an EVC and I would like to generate an EVC”

Two options are provided – Taxpayer can choose any one of the options if they do not have an EVC

i. Generate EVC through NetBanking.

ii. Generate EVC to registered Email Id and Mobile Number.

i. Generate EVC through NetBanking:

Step 1: Login to e-Filing Portal through NetBanking.

Step 2: Click on e-Verify return.

ii. Generate EVC to registered Email Id and Mobile Number:

Step 1: Enter the EVC sent to your registered Email Id / Mobile Number and

Submit to e-Verify return.

Step 2: Download the Acknowledgement (No Further action required).

Option 3 – “I would like to generate Aadhaar OTP to e-Verify my return”

Pre-requisite: Taxpayer’s PAN and Aadhaar should be linked. If Aadhaar is not linked, click on Link Aadhaar button and link the Aadhaar.

Step 1: Enter the Aadhaar OTP sent to your Mobile Number registered with

Aadhaar and Submit to e-Verify return.

Step 2: Download the Acknowledgement (No Further action required).

Option 4 – “I would like to e-Verify later/ I would like to send ITR-V”

Step 1: Click on Continue Download ITR-V

Step 2: Submit ITR-V to CPC, Bangalore.

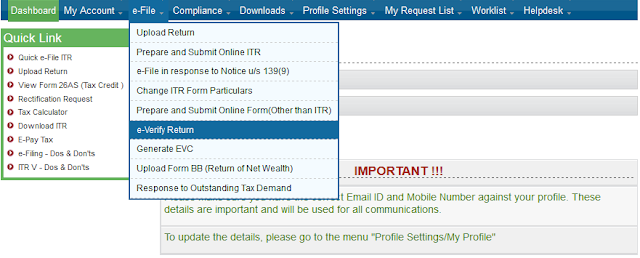

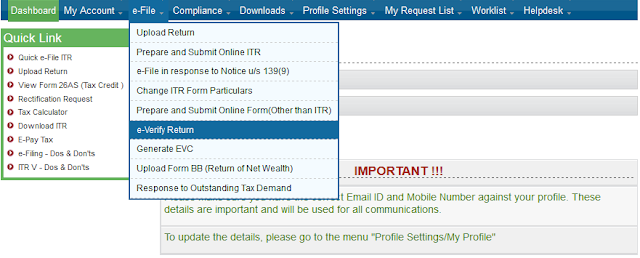

1 Click e-Verify Return under e-file.

2 Uploaded returns (120 Days) which are yet to be e-Verified are displayed in a table.

3 Click on e-Verify (for the return already uploaded)

4 Three e-Verification options provided – Taxpayer can choose any one of the options provided to e-Verify the return.

Option-1 “I already have an EVC and I would like to Submit EVC”

Option-2 “I do not have an EVC and I would like to generate an EVC”

Option-3“I would like to generate Aadhaar OTP to e-Verify my return”

2 Upload Return------Click Submit

3 The Return is uploaded (Pending for e-Verification)

4 Three e-Verification options provided – Taxpayer can choose any one of the

options provided to e-Verify the return.

Option-1 “I would like to e-Verify my return now”

Option-2 “I would like to generate Aadhaar OTP to e-Verify my return”

Option-3 “I would like to e-Verify later/ I would like to send ITR-V”

2 The Return is uploaded (Pending for e-Verification)

3 Four e-Verification options provided – Taxpayer can choose any one of the options provided to e-Verify the return.

Option-1 “I already have an EVC and I would like to Submit EVC”

Option-2 “I do not have an EVC and I would like to generate an EVC”

Option-3 “I would like to generate Aadhaar OTP to e-Verify my return”

Option-4 “I would like to e-Verify later/ I would like to send ITR-V”

Option 1 – “I already have an EVC and I would like to Submit EVC”

Step 1: Provide the EVC in the text box Click Submit.

Step 2: Download the Acknowledgement (No Further action required).

Option 2 – “I do not have an EVC and I would like to generate an EVC”

Two options are provided – Taxpayer can choose any one of the options if they do not have an EVC

i. Generate EVC through NetBanking.

ii. Generate EVC to registered Email Id and Mobile Number.

i. Generate EVC through NetBanking:

Step 1: Login to e-Filing Portal through NetBanking.

Step 2: Click on e-Verify return.

ii. Generate EVC to registered Email Id and Mobile Number:

Step 1: Enter the EVC sent to your registered Email Id / Mobile Number and

Submit to e-Verify return.

Step 2: Download the Acknowledgement (No Further action required).

Option 3 – “I would like to generate Aadhaar OTP to e-Verify my return”

Pre-requisite: Taxpayer’s PAN and Aadhaar should be linked. If Aadhaar is not linked, click on Link Aadhaar button and link the Aadhaar.

Step 1: Enter the Aadhaar OTP sent to your Mobile Number registered with

Aadhaar and Submit to e-Verify return.

Step 2: Download the Acknowledgement (No Further action required).

Option 4 – “I would like to e-Verify later/ I would like to send ITR-V”

Step 1: Click on Continue Download ITR-V

Step 2: Submit ITR-V to CPC, Bangalore.

2 E-VERIFICATION OF AN ALREADY UPLOADED RETURN (NON -NETBANKING)

1 Click e-Verify Return under e-file.

2 Uploaded returns (120 Days) which are yet to be e-Verified are displayed in a table.

3 Click on e-Verify (for the return already uploaded)

4 Three e-Verification options provided – Taxpayer can choose any one of the options provided to e-Verify the return.

Option-1 “I already have an EVC and I would like to Submit EVC”

Option-2 “I do not have an EVC and I would like to generate an EVC”

Option-3“I would like to generate Aadhaar OTP to e-Verify my return”

Now Follow Steps Given In Main Point 1 above.

3 E-VERIFICATION WHILE UPLOADING A RETURN THROUGH NETBANKING LOGIN

1 Login to e-Filing through NetBanking

2 Upload Return------Click Submit

3 The Return is uploaded (Pending for e-Verification)

4 Three e-Verification options provided – Taxpayer can choose any one of the

options provided to e-Verify the return.

Option-1 “I would like to e-Verify my return now”

Option-2 “I would like to generate Aadhaar OTP to e-Verify my return”

Option-3 “I would like to e-Verify later/ I would like to send ITR-V”

Now Follow Steps Given In Main Point 1 above.

No comments:

Post a Comment