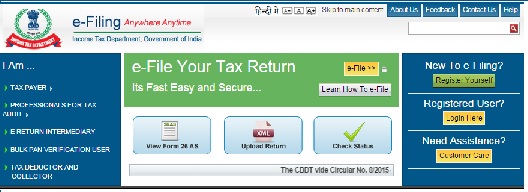

Income Tax Efiling is a very common term during this part of the year i.e. June-July, after the months of Feb-March or September. Many of us always had a question as to what is Income Tax Efiling and why are we hearing the word Efiling Income Tax more and more these days. In a laymans terms Income Tax Efiling is nothing but Electronic filing of Income Tax returns which are filed every year. As most of us know that Income Tax returns are to be mandatory filed by all the persons having total income exceeding the income not chargeable to tax.(Sec 139 of Income Tax Act, 1961).

Income Tax Efiling is a very common term during this part of the year i.e. June-July, after the months of Feb-March or September. Many of us always had a question as to what is Income Tax Efiling and why are we hearing the word Efiling Income Tax more and more these days. In a laymans terms Income Tax Efiling is nothing but Electronic filing of Income Tax returns which are filed every year. As most of us know that Income Tax returns are to be mandatory filed by all the persons having total income exceeding the income not chargeable to tax.(Sec 139 of Income Tax Act, 1961).

Now there may be a question that arise in our mind, why we should be Efiling Income Tax Return rather than filing Income Tax return Manually. There are a lot of Advantages of Efiling Income Tax returns rather than manually filing Income Tax Returns:

1. INCOME TAX EFILING WILL PROCESS QUICKER INCOME TAX REFUND:

For most of the Salaried class, LIC agents, Contractors, Commission agents etc this point is the most important point for Efiling their Income Tax return. Many of you, when receive your Paychecks or Fees part of your amount is deducted from the total amount receivable. That amount is called TDS and the amount of deduction can range from as low as 1% to as high as 20%. For example a Life Insurance agent sells a policy and earns a commission of Rs. 20,000.00 from the same, now the company will deduct an amount of Rs. 2000.00 in the form of TDS and will deposit the same as your Tax to Income Tax Department. Now to claim the amount of TDS deducted from your Income you will have to file your Income Tax returns and than claim Income Tax Refund (Including your TDS amount).

Now comes the benefit of Income Tax Efiling, the refund claim made through Online Income Tax Efiling are always received much earlier than those filed manually. Another advantage is that you will be relived from giving 10% commission to your Income Tax consultant to generate your Income Tax refund. So why file manual, Efile Income Tax and get your refunds faster.

2. INCOME TAX REFUND STATUS

Second most important advantage of Efiling Income Tax is that you can always check your Income Tax refund status. Will it not be good that you can get your refund status Online rather than visiting department and waiting for the Income Tax Officials to tell your Income Tax refund status.

To know the process to check your Income Tax Refund Status read the following post HOW TO KNOW INCOME TAX REFUND STATUS ONLINE

3.RECTIFICATION & REVISION OF THE DEFECTIVE INCOME RETURNS OR WRONG PROCESSED RETURNS

This benefit may not be useful for all but for some it is like the best advantage of Income Tax Efiling. Many of us are getting notices of Defective returns from the Income Tax Department, these notices shows the errors at the time of Efiling Income Tax Return. These errors can be of NIL Income in forms, No audit details filled etc. A Income Tax Efiled will provide the Filers a better chance to rectify or revise their return by filing corrections Online. The time provided for filing rectification is only 15 days and thus an early receipt of notice on your Email is always better than those received by Our Post Department (We all know how slow it can be).

4. INCOME TAX EFILING IS MANDATORY

Yes, you heard it right efiling of Income Tax returns are mandatory for most of the persons. Whether your income is more than Rs. 500,000.00 or you are required to get your Accounts audited by a Chartered Accountant. From this year the Income Tax Efiling is also mandatory for all the persons claiming refund and for those filing ITR3, ITR4, ITR5, ITR6 and ITR7.

5. INCOME TAX EFILING WILL KEEP ALL YOUR RECORDS AT ONE PLACE

Many of our readers will remember the days when they are in urgent need of their Income Tax Return Acknowledgments for Bank Loans, as Income Proofs, to reply notices from Department etc. But when the need arises there always arises a problem i.e. Income Tax Return is misplaced. Don't worry if you file your Income Tax return online, all your data will be stored in the Income tax server and you can take a print out of all the forms by just simply logging into your account on Income Tax website.

6. BE ENVIRONMENT FRIENDLY

NGO's, government and Other Groups are constantly making uas aware of becoming Environment friendly. All of us are trying to be Environment friendly, but are we actually. Taking small steps by just Efiling your Income Tax would mean that you would Save paper, paper saved will in turn save the trees and natural resources. So why think of taking Large steps and in turn doing nothing, take small steps from your home and save paper and be ENVIRONMENT FRIENDLY.

7. SAVES MONEY

Yes, Efiling Income Tax saves money. Now you will think how can it save money, it only takes the money earned in the form of Taxes. But no, it saves money, when you file your return manually there are more than 50% chance that there will be a mistake in the form and thus need arises for a Tax consultant i.e. Chartered Accountant, lawyers or simply an Accountant. If you Efile it online, Income Tax websites will provide you all the material required to file an error free Return of Income Tax. Now you can save thousands of your money by Efiling yourself rather than taking the help of the professionals.

8. GRIEVANCE REDRESSAL

Income Tax has recently added a new feature of Grievance redressal on its Online portal. The feature enable the Website user to ask any grievance from Income Tax Department and guess what you will receive the most helpful reply from the Officials of the department. Now why would anybody want to personally visit the Income Tax Department and ask their query regarding Income Tax and face their unnecessary tantrums rather than sitting at your home and asking your query from department.

9. EFILING, EPAYMENT AND ECOMMUNICATION

Now the most important advantage, the 3E's of the Income Tax efiling. Ever thought what is the time spent when you visit Bank and pay your Income Tax by standing in a long queue or visiting Income Tax Department and waiting in a long line for your return to be submitted or communication from department not reaching your door steps and the problem you face because of that. Every one knows these problems and hours of time wastage it does, wouldn't it be better to save this time and use it in your job, business or for most important part of our life i.e. family. Then why not Efile Income Tax and relax.

10. OTHER BENEFITS

There are many more benefits like online 26AS, PAN verification, Intimation requests, Response to Demand, Income Tax Calculator, Income Tax Softwares etc. These services are provided all on Income Tax Website and enhances the Income Tax Efiling experience.

So what are we waiting for, start Income tax efiling from now on and enjoy the benefits which you will never received in manual filing.

Please share this article with your friends and colleagues and let them also know the true advantage of Income Tax Efiling. Your comments and suggestions are really appreciated, please provide these to us so that we can write better article for our readers. Mail us your Query/Comment/Suggestions at contactcasamachar@gmail.com or write to us by using the following link: http://www.casamachar.com/p/a.html

Yes, you heard it right efiling of Income Tax returns are mandatory for most of the persons. Whether your income is more than Rs. 500,000.00 or you are required to get your Accounts audited by a Chartered Accountant. From this year the Income Tax Efiling is also mandatory for all the persons claiming refund and for those filing ITR3, ITR4, ITR5, ITR6 and ITR7.

5. INCOME TAX EFILING WILL KEEP ALL YOUR RECORDS AT ONE PLACE

Many of our readers will remember the days when they are in urgent need of their Income Tax Return Acknowledgments for Bank Loans, as Income Proofs, to reply notices from Department etc. But when the need arises there always arises a problem i.e. Income Tax Return is misplaced. Don't worry if you file your Income Tax return online, all your data will be stored in the Income tax server and you can take a print out of all the forms by just simply logging into your account on Income Tax website.

6. BE ENVIRONMENT FRIENDLY

NGO's, government and Other Groups are constantly making uas aware of becoming Environment friendly. All of us are trying to be Environment friendly, but are we actually. Taking small steps by just Efiling your Income Tax would mean that you would Save paper, paper saved will in turn save the trees and natural resources. So why think of taking Large steps and in turn doing nothing, take small steps from your home and save paper and be ENVIRONMENT FRIENDLY.

7. SAVES MONEY

Yes, Efiling Income Tax saves money. Now you will think how can it save money, it only takes the money earned in the form of Taxes. But no, it saves money, when you file your return manually there are more than 50% chance that there will be a mistake in the form and thus need arises for a Tax consultant i.e. Chartered Accountant, lawyers or simply an Accountant. If you Efile it online, Income Tax websites will provide you all the material required to file an error free Return of Income Tax. Now you can save thousands of your money by Efiling yourself rather than taking the help of the professionals.

8. GRIEVANCE REDRESSAL

Income Tax has recently added a new feature of Grievance redressal on its Online portal. The feature enable the Website user to ask any grievance from Income Tax Department and guess what you will receive the most helpful reply from the Officials of the department. Now why would anybody want to personally visit the Income Tax Department and ask their query regarding Income Tax and face their unnecessary tantrums rather than sitting at your home and asking your query from department.

9. EFILING, EPAYMENT AND ECOMMUNICATION

Now the most important advantage, the 3E's of the Income Tax efiling. Ever thought what is the time spent when you visit Bank and pay your Income Tax by standing in a long queue or visiting Income Tax Department and waiting in a long line for your return to be submitted or communication from department not reaching your door steps and the problem you face because of that. Every one knows these problems and hours of time wastage it does, wouldn't it be better to save this time and use it in your job, business or for most important part of our life i.e. family. Then why not Efile Income Tax and relax.

10. OTHER BENEFITS

There are many more benefits like online 26AS, PAN verification, Intimation requests, Response to Demand, Income Tax Calculator, Income Tax Softwares etc. These services are provided all on Income Tax Website and enhances the Income Tax Efiling experience.

So what are we waiting for, start Income tax efiling from now on and enjoy the benefits which you will never received in manual filing.

Please share this article with your friends and colleagues and let them also know the true advantage of Income Tax Efiling. Your comments and suggestions are really appreciated, please provide these to us so that we can write better article for our readers. Mail us your Query/Comment/Suggestions at contactcasamachar@gmail.com or write to us by using the following link: http://www.casamachar.com/p/a.html

No comments:

Post a Comment